In the world of cross-border commerce, businesses consistently strive to adopt comprehensive solutions to handle their online transactions efficiently and securely. In the discussion about efficient methods to receive payment online for multinational businesses, two concepts are recurring: “Merchant of Record” (MoR) and “Payment Facilitators” (PayFacs). While both play crucial roles in facilitating online transactions, they serve distinct functions and cater to different needs within the payment ecosystem. Understanding the difference between these two entities is crucial to determining which to adopt for your business if you are looking to optimize your online payment processes.

What is a Merchant of Record (MoR)?

A Merchant of Record is a legal entity that assumes the responsibility for processing and managing online transactions on behalf of a seller or merchant.

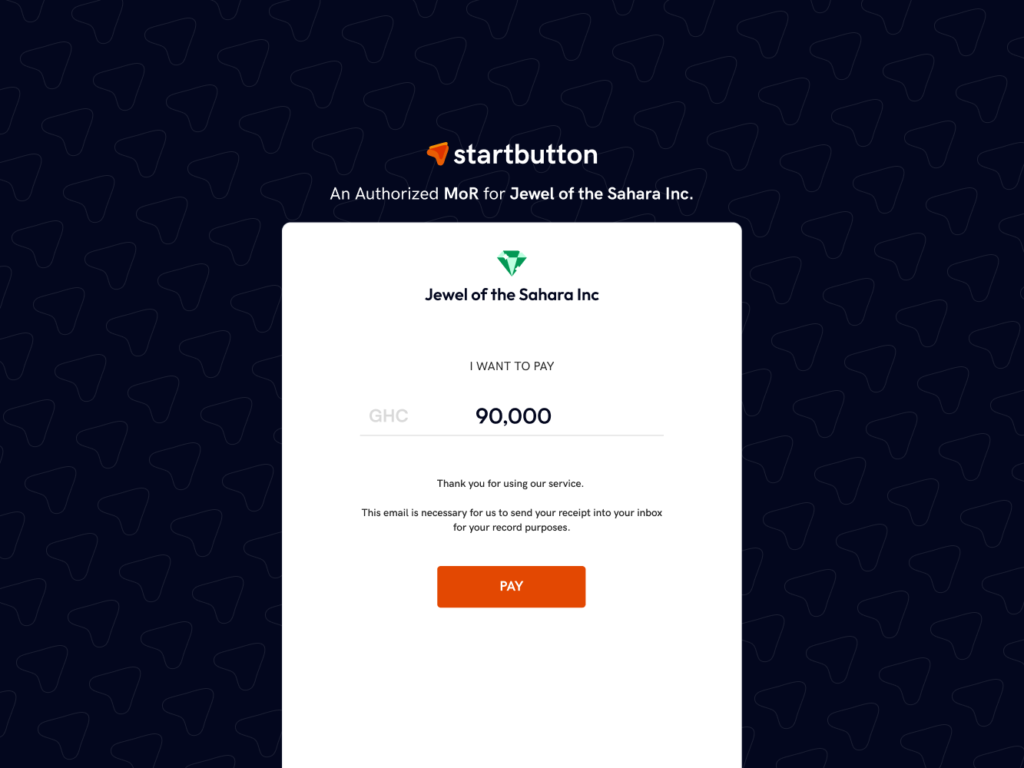

Imagine you have an online business that sells custom-made jewellery to customers in different countries, when a customer attempts to make a purchase through your online platform, the MoR steps in to handle the entire payment process on behalf of your business. From processing transactions to managing refunds and chargebacks, the MoR ensures a seamless, secure payment experience and ensures compliance with relevant local regulations in the countries where the transaction originates.

Key characteristics of a Merchant of Record include:

Legal Liability: The MoR assumes legal liability for the transactions processed, meaning they are responsible for disputes, fraud, or compliance issues that may arise.

Fraud Management: MoRs play a crucial role in detecting and preventing fraudulent transactions, protecting both the business and its customers.

Ownership of Transactions: The MoR owns the customer relationship and transaction data, providing a seamless and consistent experience for both buyers and sellers.

Reporting and Reconciliation: MoRs handle reporting tasks, generating reports detailing sales, refunds, and chargebacks, and ensuring accurate recording and reconciliation of transactions in financial records.

Regulatory Compliance: MoRs help businesses comply with financial regulations such as PCI DSS, and KYC regulations to ensure transactions remain secure and legal.

Sales tax compliance: Additionally, MoRs are responsible for calculating, collecting, and remitting sales tax, VAT, or GST to the relevant tax authorities based on the business and customer location.

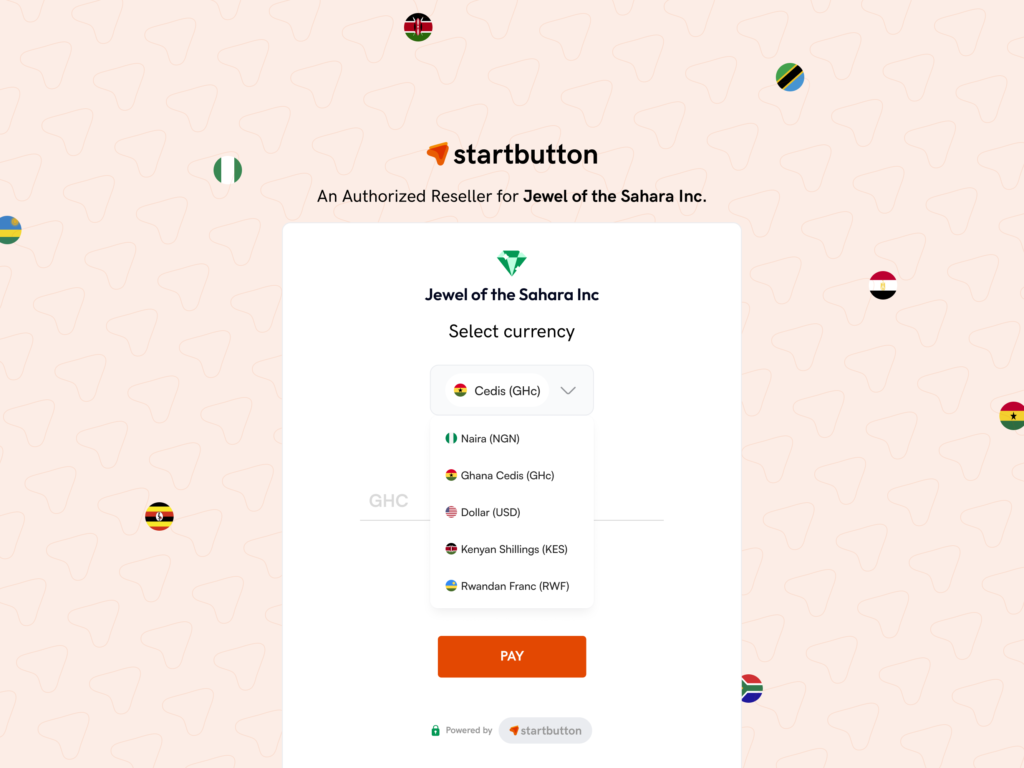

Global Expansion: MoRs typically offer services that enable businesses to expand globally by handling currency conversions, compliance with international regulations, and localization of payment methods.

What are Payment Facilitators (PayFacs)?

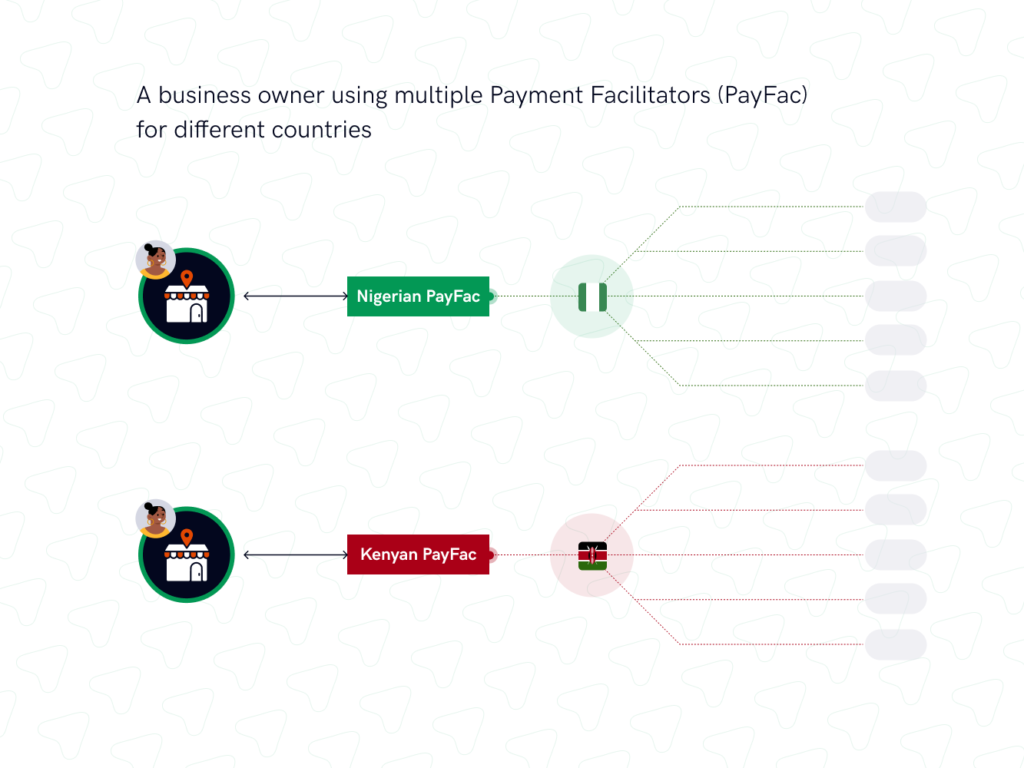

Payment Facilitators, on the other hand, are platforms that facilitate payment processing for multiple merchants under a single master merchant account. Instead of each merchant needing to establish their own merchant account with a financial institution, they can leverage the services of a Payment Facilitator to quickly and easily start accepting payments. It is essential to note that Payfacs often have depth in each market, offering a deeper understanding of local payment preferences and consumer behaviour. They typically provide solutions that cater to the unique needs of each region.

In contrast, Merchants of Records (MoRs) excel in aggregating the heavily fragmented payment options available to users in different countries, providing a unified and seamless payment experience across borders.

Key characteristics of Payment Facilitators include:

Transaction Processing: Payfacs handle transaction processing for multiple businesses using the aggregation model (explained below), simplifying the payment process for individual merchants.

Aggregation Model: PayFacs aggregate transactions from multiple merchants under their own merchant account, simplifying the onboarding process for smaller merchants.

Risk Management: PayFacs assess the risk associated with the sub-merchants they onboard. While they aim to onboard merchants quickly, they still conduct brisk assessments to mitigate fraud.

Limited legal Liability: While Payment Facilitators assume some level of risk, they typically have less legal liability compared to Merchants of Record since they do not take ownership of the transactions. Fixed Revenue Sharing Model: Payment Facilitators often operate a fixed revenue-sharing model, where they earn revenue by taking a fixed percentage of each transaction processed by their sub-merchants.

Let’s break down some distinctions between MORs and PayFacs

| Feature | Merchant of Record (MoR) | Payment Facilitators (PayFac) |

| Legal Liability | Assumes full legal liability for transactions | Assumes limited legal liability for transactions |

| Regulatory Compliance | Ensures compliance with financial regulations | Conducts brisk assessments to mitigate fraud |

| Sales Tax Compliance | Responsible for calculating, collecting, and remitting sales tax | N/A (responsibility typically falls on individual merchants) |

| Transaction Ownership | Owns the customer relationship and transaction data | Aggregates transactions under its own merchant account |

| Fraud Management | Crucial role in detecting and preventing fraudulent transactions | Assess risk associated with sub-merchants onboarded |

| Global Expansion | Facilitates global expansion by handling currency conversions and compliance with international regulations | N/A (focuses on simplifying payment processing for individual merchants) |

Choosing the Right Solution

When deciding between a Merchant of Record (MoR) and a Payment Facilitator (PayFac), businesses should consider their specific needs, scale, and growth objectives. Larger enterprises with global operations and complex payment requirements may find MoRs to be a better fit. This is because they offer comprehensive services and regulatory compliance while reducing business registration hassle. On the other hand, smaller merchants or startups looking for a quick and easy setup process may prefer the simplicity and agility offered by Payment Facilitators.

No matter which option you choose, it’s important to partner with a reputable provider that aligns with your business goals and values.

Explore Startbutton as Your Merchant of Record in Africa

For businesses operating in Africa seeking a trusted Merchant of Record solution, Startbutton provides seamless payment processing and a profound opportunity for global expansion with incorporation in more than 9 African countries. Take the next step in expanding your business across Africa by exploring Startbutton as your Merchant of Record partner today.

Send an email to hello@startbutton.africa or visit www.startbutton.africa to get started.