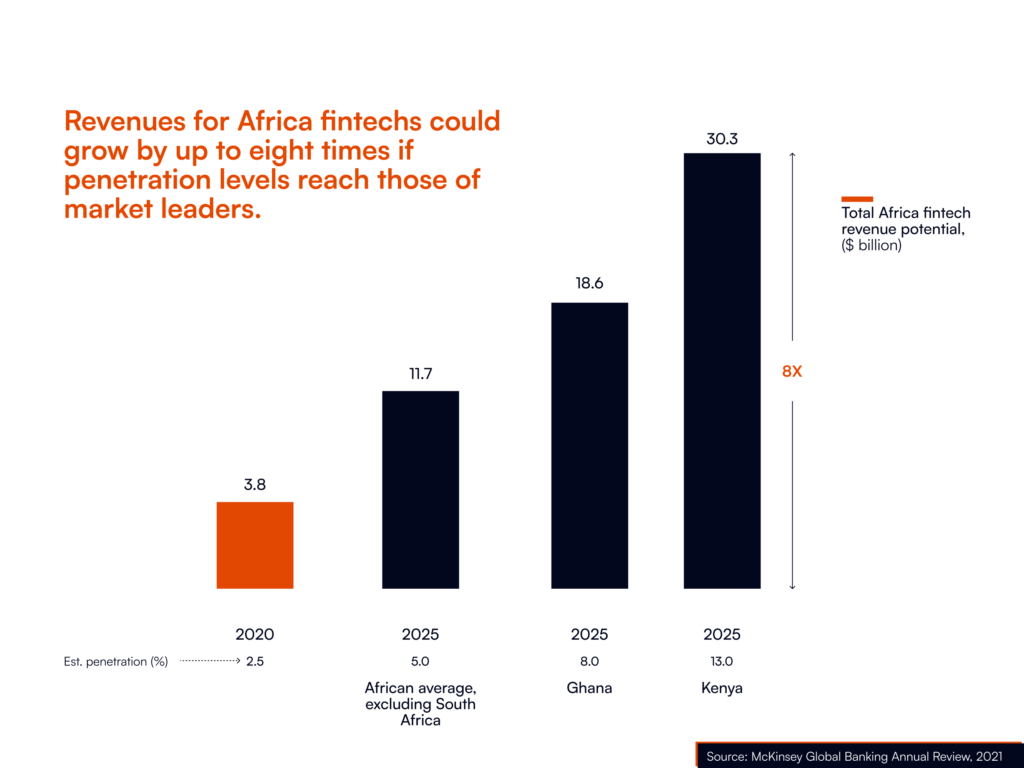

As of 2023, Africa had over 1,000 fintech companies. This number reflects a rapidly growing sector driven by increasing digital adoption and rising efforts toward financial inclusion across the continent. Despite this growth, many African fintechs have struggled to penetrate new markets substantially. A research study by McKinsey and Company suggests that fintechs could grow up to eight times if penetration levels reached those of market leaders. This shortcoming is primarily due to the absence of a comprehensive market expansion strategy, particularly in terms of product localisation.

Developing a successful market expansion and localisation strategy for new markets in Africa presents significant challenges for fintech companies. From understanding local regulations, to meeting the unique needs of local customers, the process of expanding into a new market requires thoughtful localisation. This guide offers you practical steps on how to adapt your fintech product for new African markets in other to drive market penetration and product adoption.

Conduct Thorough Market Research

Before entering a new market, thorough market research is essential. This research should cover aspects such as local regulations, competitive landscape, customer behaviour, and market demand. Understanding these factors helps fintech companies develop strategies that are well-suited to the local context. Thorough market research is the foundation of any effective market expansion strategy. It also aids in identifying potential challenges and opportunities, enabling informed decision-making.

Engage with Local Businesses and Fintech Hubs

After conducting market research, engaging with local businesses on the ground is the next critical step. This is one of the most effective ways to understand a new market. By engaging with businesses that are already established, fintechs can gain practical insights into the pain points of the target market and best practices.

A real-life case study is Quickteller Paypoint, a utility bill payment and money service. During the COVID-19 pandemic, they engaged with micro and small businesses to understand their pain points. This led to the creation of solutions that helped these businesses directly, transitioning them from cash to digital transactions seamlessly. Such local businesses include Michael Terver’s cyber-cafe. The success of Quickteller Paypoint highlights the importance of local engagement for effective market expansion in Africa and customer adaptation to new financial technologies.

What’s more? Since the growth of a fintech is driven by its ability to address the needs of underserved populations and businesses, offering financial services that traditional banks often cannot. Engaging with local businesses helps fintech companies power inclusive growth and tailor their services to very specific needs that aren’t being met by traditional institutions.

Engaging with local fintech hubs and accelerators will also provide access to networks, resources, and mentorship. These organizations often have deep insights into the local market and can offer support in navigating challenges specific to the fintech industry.

Provide Local Customer Support

Providing local customer support is more crucial than assumed when entering an African market. Generally, customers prefer to speak with support staff who understand their context and can communicate effectively in a manner they are accustomed to.

According to payment gateway solution provider Akurateco, a key challenge encountered by customers when selecting a payment provider is the need for effective customer engagement and responsive support mechanisms.

This barrier extends beyond just language; it’s also about cultural and social understanding. For example, customers in Kenya might feel more comfortable talking to Kenyan support representatives, as it communicates a sense of familiarity and trust.

By leveraging local talent, fintech companies can ensure they are better equipped to navigate the cultural and economic landscapes of African markets, ultimately leading to more robust and trusting customer relationships.

Host Community Engagement Events

Building a strong presence in a new market involves more than just offering a product; it requires active community engagement. Hosting events and interacting with local communities can help fintech companies establish themselves as part of the local ecosystem.

These events provide opportunities to understand customer needs better, receive direct feedback, and create a loyal customer base. For instance, Branch, a personal finance company, has hosted numerous community events in Kenya and Nigeria. These events often focus on financial literacy, helping individuals understand how to use digital lending platforms effectively. By directly engaging with potential users, Branch has been able to build trust and expand its user base directly through these events.

Adapt Product Features To Local Needs

Different markets within Africa have differnt needs and preferences. This is why it is crucial to adapt product features to meet these local requirements. This includes modifying existing features or adding new ones in other to achieve a rewarding product-market fit.

Payment methods like Mobile Money are more popular in Ghana than in Nigeria. By integrating features relevant to the local market, fintech companies can enhance the usability and appeal of their products. Startbutton, a Merchant of Record fintech, adapts their services to offer features that resonate with local demands, allowing merchants to receive payments using the most popular and preferred payment option in any given country. This level of customization is essential for any market expansion and localisation effort to succeed in Africa.

Leverage Local Partnerships

Running fintech operations across different countries often requires forming strategic partnerships with local companies. These partnerships can offer access to established customer bases, local market knowledge, and additional resources.

Collaborating with local financial institutions, technology providers, and even competitors can significantly aid in localization. According to Sike Bamisebi, former CEO of Cellulant, partnering with competitors can provide mutual benefits, such as increased market reach and enhanced product offerings. A good example of this is how London-based fintech Verto, eased its way into the Kenyan market by collaborating with UBA Group, Kenya. Forming such partnerships is a vital element of a robust market expansion strategy in Africa.

Pricing Strategy Adaptation

Adapting your pricing strategy to match the economic conditions of a new market is crucial for making your product accessible and attractive. This can involve offering different pricing tiers, payment plans, or discounts tailored to the local audience.

A notable example is Spotify’s pricing strategy in Nigeria, where its Premium Family plan is offered at ₦1,400 per month (approximately $1.82), significantly lower than the $15.99 per month charged in the United States. By pricing their services in local currencies, Spotify ensures that the pricing is relevant and affordable for the local market, thereby increasing accessibility and adoption.

Brand Localisation

Localizing your brand involves more than just translating content. It requires adjusting your brand’s messaging, visuals, and overall presentation to resonate with the local culture and values. This might include using local languages, cultural symbols, and addressing local pain points in your marketing campaigns. Effective brand localization is a critical aspect of a comprehensive localisation and market expansion strategy.

Feedback and Iteration

Once your product is launched in the new market, continuously gather feedback from customers and iterate on your offerings. This agile approach allows you to make necessary adjustments based on real-time customer insights, ensuring that your product remains relevant and effective in meeting local needs. Continuously refining your product based on feedback is crucial for maintaining a successful market expansion.

Ready to expand your business to new African markets? Startbutton makes market entry seamless with tailored cross-border payment and compliance solutions. Discover how we can help you expand and thrive. Visit us at www.startbutton.com or email us at hello@startbutton.africa to get started today!